Social Disability Lawyer Blog

Work Credits for Social Security Disability in 2020

Disability has immediate and lasting consequences for a DI claimant. Not only a limiting disability/impairment can happen to anyone – especially with an advancing age – it can greatly affect a claimant's economic situation. The claimant's gross income earnings, household standards, total family income and purchases of essentials such as grocery and travel, all fall significantly.

Generally, people who have either quit work due to disability or are disabled and have not yet reached retirement age and have been unable to work for more than 12 months or more, qualify for disability. The benefits will usually continue until you are able to work again after the grace period of disability ends starting from the Trial Work Period (TWP), Extended Period of Eligibility (EPE) and the Ticket to Work Program (TTW).

What are Work Credits?

Work credits are earned when a person has paid FICA taxes on his/her monthly wages to the Social Security system. A person needs to have earned a minimum of 40 work credits throughout their work history, with a maximum of total of 4 earnable credits per year of their 'work years'. Once a DI claimant or the person on whose Social Security a dependent applies for SSDI has met the 20 credits condition, they are assigned eligibility to apply for SSDI by the SSA.

How are Work Credits earned?

The work credits are necessary to receive Social Security Disability benefits, Social Security Retirement and Medicare benefits. Each claimant can receive a total of 4 work credits each year, however, the work credits may also depend on the type of occupation and work that they do and how much they earn. For 2020, social security claimants need to earn a minimum wage of $1410 to earn one credit. So, for instance, a person's annual gross income is $7000, they will get a maximum of 4 work credits for that year that is 1 work credit for every $1410 earned. Similarly, if a self employed person with an unstable income earns $700 a month for only 6 months a year, they will have an annual income of $4200, which will earn them 2 work credits for each $1410. So, in order to qualify for applying to Social Security, a worker needs to be able to work a total of 20 work credits over the time with a maximum of 40 depending on the age. Hence, when a person has earned $5640, they will earn a total of 4 work credits for that year. Any income earned above that limit will not be counted towards calculating work credits for that year.

Age Requirements for work credits

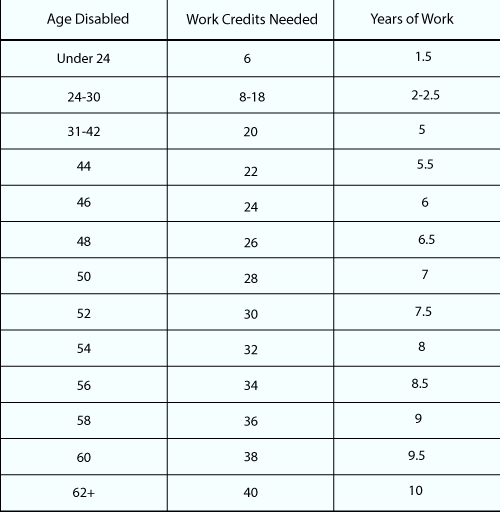

The SSA requires that in order to qualify for disability benefits, the number of work credits will depend on the age. However, there is a rule for the additional 20 work credits, to be earned after the initial 20 work credits. The next 20 work credits need to have been earned within the last 10 years ending with the year you became disabled. The younger workers may qualify for SSDI with lower work credits. Here is a chart representing the work credits needed for each age group starting from age 24 to retirement age (60 to 65 years of age).

How to prove your work history?

Generally, a person's employer may already have a portion of their paychecks submitted to the Social Security Administration as Social Security taxes (FICA taxes). However, if not, workers can also choose to do so on their own. The SSA will have a record of your earnings and workers are able to view their earnings and total Social Security taxes submitted through their account on the SSA website.

What happens if you do not have enough work credits for your age?

If a worker does not meet the requirement for the total work credit for that age, they will not be able to apply for the Social Security Disability Insurance. It might be possible that a person had never been able to work enough to earn sufficient work credits for SSDI – in that case, they may be eligible to receive the Supplemental Security Income (SSI). This is because the SSDI is a work credits-based program, whereas, the SSI is a needs-based program.

** Remember that whatever your age, you must have earned the required number of work credits within a certain period ending with the time you become disabled. If you qualify now but you stop working under Social Security, you may not continue to meet the disability work requirement in the future.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.

Comments