Social Disability Lawyer Blog

Calculating your Social Security Disability in 2021

If you're applying for SSDI benefits, then your disability paycheck amount depend on your average lifetime earnings before you became disabled.

Unlike Supplemental Security Income (SSI) which is purely a need-based disability programme, the Social Security Disability Insurance (SSDI) programme is purely a merit-based insurance programmer. The SSA determines if a person is disabled enough to grant them benefits. However, the severity of a claimant's impairment does not affect the amount of their disability paycheck.

Primary Insurance Amount (PIA) for AIME

The primary insurance amount is the result of a calculation used to determine the social security benefits amount payable to an eligible retiree at full retirement age.

In order to determine the PIA, the Average Indexed Monthly Earnings (AIME) must first be calculated. You can click here to learn how it is calculated. Once it is done, the government divides the AIME amount into three percentages – fixed at 90%, 32% and 15% - to calculate the PIA.

For 2021, the Primary Insurance amount for the first 90% is set at the first $996, then 32% for the next amount greater than $996 and lower than $6002. Then next is 15% of the amount above $6002 and below $6500.

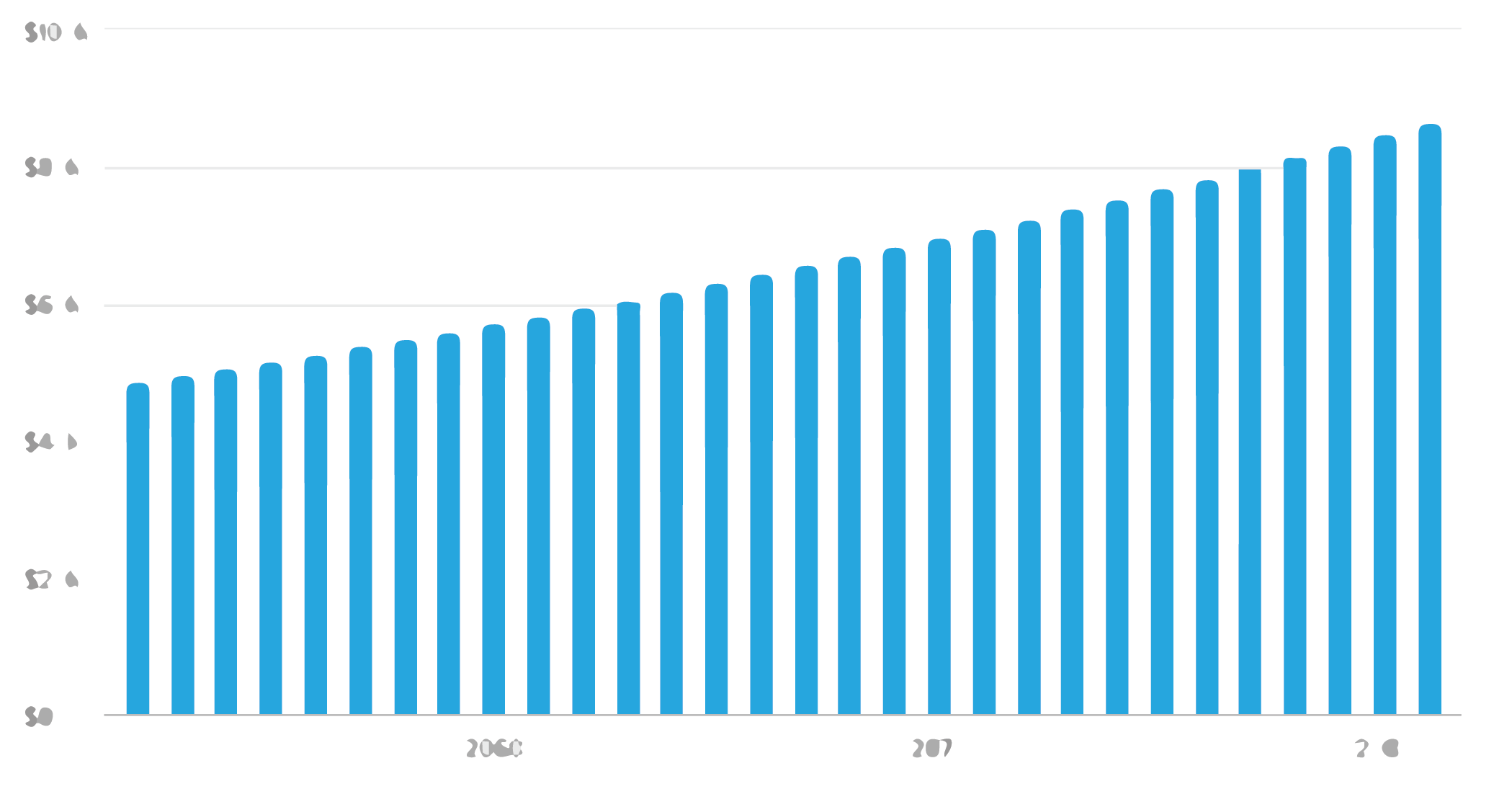

The SSA requires that a claimant must have worked and paid the required amount of social security taxes for atleast 35 years of their working years under substantial gainful activity. Although the average SSDI payment is now $1277, the actual payment varies for each claimant. For instance, for a 66 year claimant born in 1986 with an annual income of $75,513 - the total SSDI amount payable would be $48,771. This amount is calculated by the person's birth year, age and the year in which they get elected to receive the benefits.

However, in order to be eligible, a claimant must have enough work credits and work years (35 work years at full retirement age) to begin with.

All of these calculations could be done at the Social Security Administration's official page and through their built in calculator on official site. However, you must have your social security ID made and at hands to calculate it instantly. To calculate your PIA, you can enter your AIME here.

** Note that if you receive disability benefits from a private source, like a private pension or private insurance benefits, it will not affect your SSDI benefits amount. If, however, you receive other public disability benefits, they it may change the payable amount of your SSDI benefits. For instance, if you were injured on the job and are receiving workers' compensation benefits, the amount of SSDI benefits you receive might be reduced.

Consult a Disability Attorney

Having the right knowledge to navigate around the whole process of determining your social security benefits is critical in helping you win benefits in the first attempt. If you are unsure of how to proceed you can seek legal help from our professional disability attorneys to determine how much of your earnings as a claimant need to be over your lifetime in order to reach a desired monthly retirement benefit.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.

Comments